PM lauds PEC for developing NSS-based…

PM lauds PEC for developing NSS-based building code

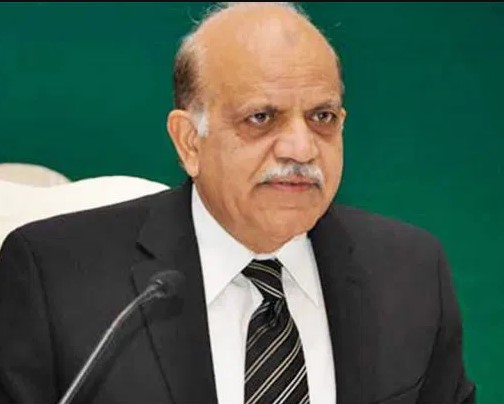

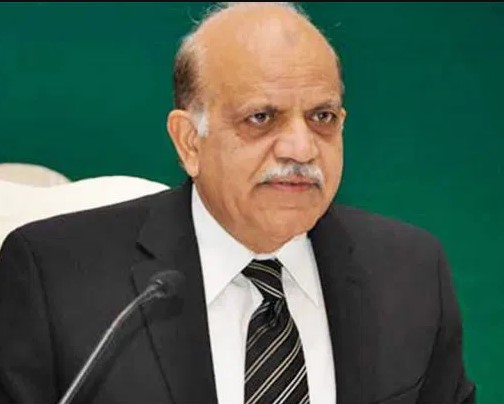

Zaigham Mahmood Rizvi

Zaigham Mahmood Rizvi zaigham2r@yahoo.com

July 2020

SUMMARY OF ACHIEVEMENTS

Expert Consultant on Housing and Housing Finance to the World Bank, IFC, UN-ESCAP, UN HABITAT and other international institutions;

Forty years of professional experience in various fields including housing finance, development banking, manufacturing and academia. Thirty plus years’ experience in the financial sector of Pakistan, eight years at a development finance institution in the Sultanate of Oman, and about 10 years for World Bank as Affordable Housing Consultant.

Have served in Asia-Pacific, MENA and African region under various assignments from multilateral institutions. namely World Bank, IFC, UNHABITAT, DFID, CMHC-Canada etc in the area of Low-Income Housing, Social Housing, Housing Microfinance,

Proven track record of successful turnarounds of financial institutions in Pakistan and the Middle East;

Mortgage Refinance Institutions: Served on the Board of Directors of Egyptian Mortgage Refinance Company (EMRC), Palestine Mortgage and Housing Corporations (PMHC) as IFC Nominee Director. Served as Expert Consultant to World Bank Group as team member to carry out feasibility study of Pakistan Mortgage Refinance Company (PMRC);

Long Term Liquidity and market based instruments: Played active role in promoting long-term liquidity instruments like Mortgage Backed Bonds/Sukuks and REITs. Had designed and successfully launched Pakistan’s first Mortgage Backed Sukut (MBS) of Rs One Billion for HBFC-Pakistan, and Pakistan’s first listed Islamic-REIT, a commercial REIT to provide long-term funds for Dolmen Mall;

Well-versed in the cultural nuances, working environment, business modalities, and socio-economic aspects of countries in Asia-Pacific, Africa and the Arab World;

Played a key role in promoting and setting up Sharia-Compatible financial institutions in Pakistan;

Played a key role in establishment of Pakistan’s Premier Islamic Bank, the Meezan Bank, now the leading Islamic bank of the country,, with more than 750 branch network.

Played a pioneering role in establishment and promotion of Mutual Finds Industry in Pakistan, including launching of Sharia-Compliant Mutual Funds (Open –End and Closed-End). Have served as Founder Chairman of Mutual Funds Association of Pakistan for 10 years, and a member of International Investment Funds Association;

Was awarded the “Outstanding CEO Award” from ADFIAP-Manila in 2004;

Maintaining a strong linkage with academia, as an author and visiting faculty, and in bridging the gap between the Academia and the Industry;

Regularly contributes articles to Housing Finance International (HFI), the Quarterly Journal of International Union for Housing Finance (IUHF);

Founding Chairperson of Center for Affordable Settlements and Housing;

Served as Team Lead on Working Group for Low-Income Affordable Housing Policy and Program “Apna Ghar” in Pakistan;

Architect of PTI’s Govt Housing Policy and Program “Naya Pakistan Housing Program” aiming at building 5 mn housing units, covering Urban, Peri-Urban and Rural Housing. It will be first time in Pakistan that Rural Housing and Peri-Urban Housing is being addressed at national level and on a large scale. and am serving as Chairman Prime Minister’s Housing Task Force

Advocacy for alleviation of Energy Poverty in low-income segments of population, and project promotion in the fiend of Alternate Energy options, mainly Solar Energy.

Advocacy for environment friendly renewable energy and awareness for, “Green Housing”, “Carbon Footprint” and Clean Development Mechanism in Pakistan

Social Service: Serving Persons with Disabilities (PwDs) for last 40 years. Have been actively engaged in service of PwDs for more than three decades. Primary focus is on Hearing Impaired/Deaf and Visually Impaired/Blind Persons. Founder and patron of various social services organizations serving Persons with Disabilities, more so Deaf Persons. Authored PTI Policy for Persons with Disabilities, which was made part of PTI Manifesto. Actively working with the Government for design and implementation of various initiatives to serve the cause of PwDs.

EDUCATION

M.B.A. (Oklahoma State University, USA - 1977) GPA 3.9/4.0

M.A. Economics (Punjab University, Lahore, Pakistan - 1973) 1st Division

M.Sc. Engineering (Engineering University, Lahore, Pakistan - 1970) 1st Division

CERTIFICATIONS

Diploma, Institute of Bankers Pakistan (Gold Medalist)

Associate Institute of Chartered Secretaries of Pakistan (ACIS)

Associate Development Bank Management by ADFIAP-Manila

“Certified Director” and qualified Director Education Program of Pakistan Institute of Corporate Governance (PICG)

PROFESSIONAL SUMMARY

Housing and Housing Finance:

Served as GCC Advisor on Housing Policy and Finance to Affordable Housing Institute (AHI) of USA for an assignment in Kuwait.

Served as Expert Consultant on Housing and Housing Finance to the World Bank, IFC, UN-ESCAP, UN-HABITAT, CMHC of Canada, and ShoreBank Int’l USA internationally applied my extensive background in Housing and Housing Finance, Low-Income Affordable Housing, Development Banking, and Islamic Banking, including the application of Sharia-Compatible models in:

• MENA Region: Oman, Egypt, Palestine, Saudi Arabia

• South Asia: Afghanistan, Pakistan, India, Bangladesh, Sri Lanka

• East-Asia: Indonesia, Mongolia, Thailand, Philippines, Singapore, Hong Kong, Vietnam, Korea, Fiji

• Africa: Kenya, Zambia, Uganda, Botswana, Malawi, Senegal and Ghana

Served as Advisor on Infrastructure and Housing to Central Bank of Pakistan (SBP)

Team Lead of Working Group on Low-Income Housing Policy in Pakistan and member Steering Committee to implement 500,000 low-Income Housing Project of Govt. Of Pakistan (Apna Ghar).

In Afghanistan, under various assignments, I have been involved in low-income housing, housing microfinance particularly rural housing finance, review of regulatory regimes, sharia-compatible housing finance, and role of institutional housing finance to prepare a comprehensive overview of housing finance and housing supply and to suggest business models for Way-Forward. For an assignment with First Micro-Finance Bank of Afghanistan (FMFB-A), has developed, and successfully piloted Rural Microhousing Finance Product.

In Bangladesh, working for the World Bank as Expert Consultant in Housing and Housing Finance, have conducted a Diagnostic Study and Restructuring Study of Bangladesh House Building Finance Corporation. Under another study have carried out an overall assessment of housing sector of Bangladesh, its issues and possible answers. As Secretary General of Asia-Pacific Union for Housing Finance (APUHF), am constantly in contact with the main stakeholders of housing in Bangladesh, including Bangladesh House Building Finance Corporation (BHBFC), Developers Association (REHAB), and financial institutions involved in housing finance like Islamic Bank Bangladesh.

Have remained actively involved in development and promotion of Long Term Liquidity Facility Institutions like Mortgage Refinance Institutions, and Instruments like REITs, Mortgage Backed Sukuks, and Property Backed Listed Instruments in the Capital Market etc.

Establishing physical and web-based low-income housing research center based in Pakistan- Center for Affordable Settlement and Housing (CASH)

Currently engaged in establishing a platform to bridge the gap between Academia and Field Practioners/Developers in the area of research on low–cost housing materials and low-cost construction technologies.

Addressing the challenge of Energy Poverty: Mr. Zaigham strongly believes in Alternate Energy, more so the Solar Energy as source of Electricity, as the only viable, sustainable and affordable option to address energy poverty of the poor. He is a strong proponent of Solar for Social Housing, while addressing low-cost affordable housing, more so when such a habitat is located in Off-Grid and Under-Served areas. Under the model, housing finance is clubbed with financing of solar installation at the house right at the construction stage, and repayments are also clubbed under one loan installment. He advocates community-run Solar Water Pumps to supply potable water to such communities. In Pakistan, Mr. Zaigham is associated with IFC’s Lighting Pakistan Project, a sub-component of IFC’s Lighting Global Program. Nearly one-third of Pakistan’s 200 million population is Off-Grid, and another 74 million people are under-served, facing power outages of 12 hours or more. Lighting Pakistan Project aims at providing affordable lights and fans to such habitat. He is also associated in a program to provide water in such areas through Solar Water Pumps, and where needed additionally installing RO Systems with such Solar Water Pumps. Mr. Zaigham is actively engaged with Pakistan’s leading Microfinance Institution, the Akhuwat Foundation, for promoting affordable solar energy solutions like Solar Lanterns, Solar Lights, Solar Fans to nearly two-third of country’s population, which is Off-Grid and or Under-Served.

Environment and Renewable Energy: Actively engaged in promoting awareness on “Green Housing” as well as “Carbon Footprint” and need for active “carbon Credit” Market

Water Conservation, Water Recycling and Rain Water Harvesting: Advocacy and incorporating remedial measures for water conservation in housing and development of large scale housing projects as well as in Industrial Estates.

Sharia-Compatible Financing and Financial Institutions: I have played a key role in promoting and setting up Sharia-Compatible financial institutions in Pakistan, which includes an Investment Bank (Al-Meezan Investment Co.), a Commercial Bank (Meezan Bank Ltd), a Takaful Insurance Company (Takaful Pakistan Ltd) and an Asset Management Company (Al-Meezan Investment Co. Pakistan).

Contributions to Academia: I have maintained a strong linkage with academia during his career. He has served as Teaching Assistant at Business Department of Oklahoma State University, USA and has served as Visiting Faculty to the Business Departments of both Quide-e-Azam University in Islamabad and the Institute of Business Administration in Karachi, Pakistan. Rizvi has published many articles/papers and made contribution to field research projects primarily in the area of Pro-Poor Affordable Housing, Housing Finance and Alternate Energy options for low-income segments of the population. He is currently in the process of authoring two books in the area of Housing and Housing Finance.

PROFESSIONAL EXPERIENCE

Consultant - Housing & Housing Finance: World Bank Group, USA January 2008 onwards

Conducted a diagnostic study of the Bangladesh House Building Finance Corporation (BHBFC) with the aim of developing a possible reform and rehabilitation program for BHBFC. Under another study have carried out an overall assessment of housing sector of Bangladesh, its issues and possible answers.

Served as IFC’s Nominee Director on the Board of Palestinian Mortgage & Housing Corporation (PMHC), Palestine and Egypt Mortgage Refinance Company (EMRC), Egypt. In Palestine, was involved in the World Bank’s Technical Assistance Program for design and execution of a large scale Affordable Housing Initiative.

Prepared a Report on Housing Finance in South Asia Region, covering Afghanistan, Pakistan, India, Bangladesh, and Sri Lanka. The report served as background information and research material for the World Bank publication “Expanding Housing Finance to the Underserved in South Asia’ authored by Ms. Tatiana Nenova (August 2010). Also involved in drafting and review of the publication.

Member of the team which conducted a study for Pakistan Mortgage Refinance Company (PMRC).

Worked for the World Bank on an assignment to prepare a comprehensive study on East-Asia Housing Finance Scenario and housing regulatory regimes.

In 2016, served as Team Member on two different Low-Income Housing Studies in Pakistan, where clients were State Bank of Pakistan (the central bank) and Asian Development Bank.

Consultant - UN-ESCAP/UN-HABITAT 2008

Worked on UNESCAP’s sponsored project on “Pro-Poor Housing Finance in Asia and Pacific - a compendium of seven countries.”

Senior Housing Advisor – ShoreBank Int’l, USA (now Enclude-USA) 2011-2013

ShelterAfrique, Africa: Worked as Team Lead with ShoreBank Int’l, Washington DC, on an assignment to develop the Social/Microhousing Housing Program in Africa with a focus on seven select countries including Kenya, Uganda, Zambia, Botswana, Malawi, Ghana and Senegal. It was a comprehensive assignment, covering all aspects of Social Housing Supply, Social Housing Finance, Regulatory and Policy recommendations.

First Micro-Finance Bank, Afghanistan: The assignment covered design and development of a Business Model of Rural Housing Micro Finance and Product Line for First Micro Finance Bank (FMFB), Afghanistan.

Worked in Afghanistan for ShoreBank Int’l on an IFC assignment to prepare a comprehensive study on housing demand, supply and regulatory aspects with a set of comprehensive recommendations and way-forward.

Canada Mortgage and Housing Corporation-CMHC

Served as Team Member of CMHC providing advisory services on housing to a Govt. entity in Saudi Arabia.

Advisor - State Bank of Pakistan (SBP), Pakistan 2008 - 2013

Served as Honorary Adviser to State Bank of Pakistan (the central bank) on Infrastructure and Housing. The position involves advising SBP in its programs for promotion and regulation of housing, real estate and infrastructure in Pakistan.

Managing Director/Chairman - House Building Finance Corporation (HBFC),

Pakistan 2005 - 2007

Served as Chairman and MD of HBFC. Initiated Pakistan’s first “Small and Medium Housing (SMH)” finance program targeting low and middle-income groups.

Recovered large amounts of default loans and transformed a massive non-performing loan portfolio into performing assets through aggressive loan recovery programs. The NPLs Ratio improved from 67% to 37 % during the period.

HBFC experienced a complete turnaround from an ailing financial institution to a proactive, socially responsible and commercially viable housing finance entity in only three years.

Implemented a comprehensive reforms program covering human resource development, preparation of systems and manuals, computerized the loan origination process, etc. HBFC attained ISO 9001-2000 Certification under my tenure.

Enhanced market image through improved customer service.

Elicited International Finance Corporation’s (IFC) technical support for development of long-term Business Plan, and Capacity Building Program.

Instituted a plan for setting up a Social Housing Company to specialize in the development of housing for the low and middle-income groups and a Social Housing Bank to focus on micro-housing finance.

Introduced and launched country’s first Securitization of Mortgage-Backed Debt Obligation-MBS (Sukuk or Islamic Bonds).

Also introduced the concept of Pakistan’s first Sharia-compatible REIT (i-REIT).

Managing Director - Pak-Kuwait Investment Company, Pakistan 2001 - 2004

At this Joint-Venture Development Finance Institution between the Governments of Pakistan & Kuwait, increased balance-sheet size, profitability, and shareholders’ equity to unprecedented levels. The Company’s four-year average profit was three times higher than the highest cumulative profit of previous twenty years.

Attained “AAA” credit rating by two agencies, Corporate Governance Rating of CGR-9 (on a scale of 10) as well as ISO Certification, making this the first financial sector institution in Pakistan with these honors.

Company was also awarded ADFIAP’s ‘Corporate Governance Award’ for its initiative and pro-active compliance of Corporate Governance Standards.

Managing Director - Pak-Libya Holding Company, Pakistan 1996 - 2001

At this Joint-Venture Development Finance Institution between the Governments of Pakistan & Libya, increased balance-sheet size, profitability, and shareholders’ equity.

Improved credit rating from “A” to “AA” and secured ISO Certification.

Improved market standing and perception.

Senior Executive Vice President - Saudi-Pak Industrial & Agricultural Investment Company, Pakistan 1986 - 1996

At this Joint-Venture Development Finance Institution between the Governments of Pakistan & Saudi Arabia, served in all functional areas, namely Merchant Banking, Development Banking, Project Financing, Monitoring, Administration, and Corporate Affairs.

Actively coordinated with Saudi Government to set up industries with an export potential from Pakistan to Saudi Arabia.

Manager Projects - Oman Development Bank, Oman (a DFI) 1979 - 1986

A member of the Bank’s start-up team and Head of the Projects Dept.

Worked with the Ministries of Industry and Commerce to identify industrial projects for diversifying Oman’s economic base from oil to non-oil sectors.

Most of the industrial projects set up during the given period are now the most established and successful companies listed in the Muscat’s Securities Market.

Senior Officer - Industrial Development Bank, Pakistan (a DFI) 1977 - 1979

Involved in the troubleshooting of sick industrial projects and sectors.

Operations Engineer - Dawood Hercules Chemicals Limited, Pakistan 1970 - 1975

Chemical Engineer in operations of the Fertilizer Plant.

General

Initiated programs for Social Housing Supply and Social Housing Finance at HBFC-Pakistan.

Maintains an active review and follow-up of Low-Income Housing (LIH) Programs and Initiatives in Asia-Pacific.

Played a pioneering role in establishing Asia-Pacific Union for Housing Finance (APUHF www.apuhf.info), and serving as its Secretary General.

Serving as Advisory Board Member of Asia-Pacific Journal of Housing Finance being published by Government Housing Bank of Thailand.

Clean Energy: Advocacy for alleviation of Energy Poverty in low-income segments of population, and project promotion in the fiend of Alternate Energy options, mainly Solar Energy.

DIRECTORSHIPS

Director on the Board of Islamabad Stock Exchange, the Karachi Stock Exchange and the National Commodities Exchange of Pakistan.

Founder/Director on the Board of Meezan Bank Ltd Pakistan, the premier Islamic bank in Pakistan, Al-Meezan Investment Co. (an asset management company), and Takaful Pakistan Ltd. (Islamic Insurance company).

Director on the Board of Dubai Islamic Bank of Pakistan as an Independent Director.

Nominee Director on the Boards of various corporate entities in financial and manufacturing sector.

Board of Egyptian Mortgage Refinance Company (EMRC) (Nominee of IFC).

Board of Palestine Mortgage and Housing Corporations (PMHC) (Nominee of IFC).

HONORS, AWARDS AND RECOGNITIONS

Honored with the “Outstanding CEO Award” from Association of Development Finance Institutions in Asia-Pacific (ADFIAP) in 2004

Fulbright Scholar – USA (1975-77).

Honored with the ‘IT Pioneer Award’ from National Cash Register (NCR), Pakistan.

Vice Chairman of Association of Development Finance Institutions in Asia and Pacific (ADFIAP) representing nearly 100 financial institutions from 35 countries of Asia-Pacific region.

Founder and Ex-Chairman of Mutual Funds Association of Pakistan (www.mufap.com).

Founder and Ex-Chairman of Association of Mortgage Bankers of Pakistan.

ACADEMICS

Visiting Faculty, Department of Business Administration, Quaid-e-Azam University, Islamabad, Pakistan.

Visiting Faculty, Institute of Business Administration (IBA), Karachi, Pakistan.

Visiting Faculty, National Institute of Banking and Finance, Islamabad, Pakistan.

Research Assistant, Department of Business Administration, Oklahoma State University, USA.

Regularly invited to speak at various training courses, workshops, and seminars in banking, finance, and economics.

SOCIAL SERVICES

Founder and Chairman of Sir Syed Deaf Association, Pakistan, a non-profit organization serving hearing-impaired people (www.sda.com.pk).

Chief Patron of Pakistan Association of the Deaf (www.padeaf.org), Sargodha Deaf Association, Muslim Deaf Center, Lahore etc.

Organizes various events to promote the cause of PwDs.

Founder of Pakistan’s net-based NGO (www.net-NGO.org) serving disabled and needy people in Pakistan.

LANGUAGES

Fluent in English, Urdu/Hindi, and exposure to Arabic and French.

***

Experience

Completed

Successful

Asia Pacific Union for Housing Finance https://apuhf.info

Chief Patron of Pakistan Association of the Deaf (www.padeaf.org), Sargodha Deaf Association, Muslim Deaf Center, Lahore etc.

Founder and Chairman of Sir Syed Deaf Association, Pakistan, a non-profit organization serving hearing-impaired people (www.sda.com.pk).

I like this group more and more each day. It makes my life a lot easier. It's really wonderful to be able to get support from like minded entrepreneurs. And Anna is always available to advise us. Thank you so much!

Wow what great experience, I love it! It's exactly what I've been looking for. Anna's group was the best investment I ever made. I don't know if I would have ever made it without her guidance and support!

My Professional Resume

To remove housing shortage, provide houses to all, arrange shelter for shelterless people, make housing affordability a means not just an aim, and give rural people a life of contentment and ease. Our Mission is also to make doing business easier, when all the housing stakeholders like developers, contractors, material suppliers, finance providers, law makers et al would be doing their part of business of providing houses to all, and we should do our level best to encourage all these stakeholders to do their parts with fullest missionary zeal.

Vision To be the prime housing finance institution of the country, providing affordable housing solutions to low and middle income groups of population by encouraging new constructions in small & medium housing (SMH) sector. Mission To be a socially responsible and commercially sustainable housing finance institution. Core Values Integrity Customer Focus Commitment to Excellence Innovation

OBJECTIVE OF THE ‘ACASH’ CENTER ‘ACASH’ is the abbreviation of Advisory Center for Affordable Settlement & Housing. Its main objective is to facilitate ‘authentic’ and ‘timely’ availability of information, especially on settlements and housing, which is the key factor in efficient decision making; To facilitate all efforts of stakeholders towards provisions of affordable settlements and Housing solutions. The stake holders include related policy makers, urban planners, architects, academics, sectoral developers, NGOs, donor agencies, national and international organizations, researchers and public/ private/ people sector players interested.

Business Administration - GPA 3.9/4.0

M.A. Economics 1st Division

M.Sc Engineering 1st Division

We share our news and blog

Need Some Help?